Rarely in American politics has a new industry spent so much money, with such apparent impact, as the cryptocurrency business did in the last election. “Cryptocurrencies” like Bitcoin, are digital assets, created and maintained by networks of computers. Mystifying to some and mesmerizing to others, they’re used for transactions and as high-risk investments with potentially high rewards. At least 17 million Americans own crypto, and how the industry should be regulated in the U.S. has been the subject of much dispute. With an important piece of legislation now before Congress, perhaps it’s no surprise that big crypto companies were among the top donors in this past election. And since the election, the price of Bitcoin has hit record highs. It isn’t clear whether the crypto industry will get Congress or the incoming Trump administration to craft the regulation or the legitimacy that they seek. But they’ve been investing a whole lot of their own cash to get something….

In the final months of a hotly contested race for a Senate seat in Ohio, Republican Bernie Moreno received $40 million of positive ads from a political action committee known as a super PAC.

The ads didn’t mention cryptocurrency at all, but they were paid for by crypto companies. and they helped Moreno defeat Democrat Sherrod Brown…

… the chairman of the Senate Banking Committee, and an outspoken critic of crypto.

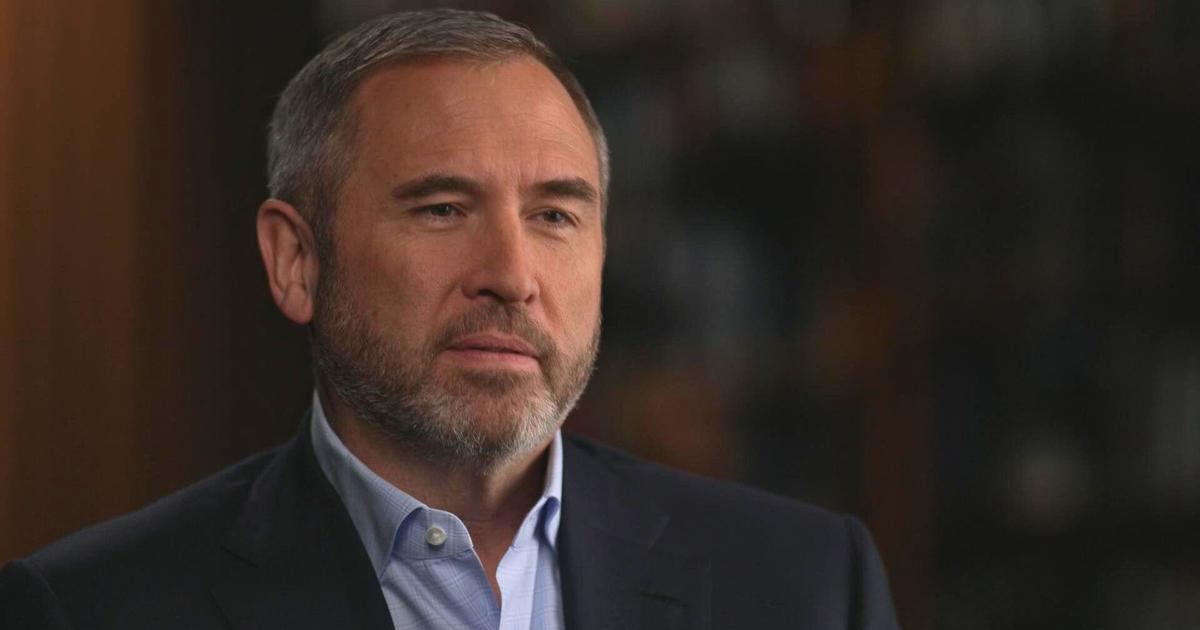

Margaret Brennan: In a close election that kinda money makes a huge difference, particularly in the end of a cycle. Do you think you tipped the scales?

Brad Garlinghouse: Do I think that putting that amount of money in the Ohio election had an impact? Absolutely.

Brad Garlinghouse is the CEO of a company called Ripple, whose cryptocurrency XRP became the third-largest in the world this past week. Ripple and two other companies contributed $144 million to super PACs that supported pro-crypto Republicans and Democrats.

60 Minutes

Brad Garlinghouse: Do I think we had an impact to elect a Democratic senator in Michigan– Elissa — Slotkin? Yes, absolutely. Do I think we had an impact in Arizona? A Democratic senator in Arizona, Gallego, absolutely.

Overall, crypto companies contributed one-third of all direct corporate contributions to super PACs. Of the 29 Republicans and 33 Democrats the industry backed in congressional races, 85% won.

Brad Garlinghouse: It’s incredible.

Margaret Brennan: So you see this election as a major victory?

Brad Garlinghouse: For sure.

Margaret Brennan: But some people will look at that and say, “You teamed up and bought an election.”

Brad Garlinghouse: At the end of the day, voters voted. We– we– we educated voters, as many industries do, about candidates.

Margaret Brennan: But you helped supercharge the candidates with the money in the coffers, right, on whatever it is–

Brad Garlinghouse: We absolutely did.

Margaret Brennan: –they wanted to talk about.

Brad Garlinghouse: That’s absolutely right.

Margaret Brennan: So, in your mind, is the message for any lawmaker looking to run for office that they have to take your industry seriously? Fear your industry?

Brad Garlinghouse: I think all citizens should want people in Congress, in the Senate and the House, who are going to look to how do we use technologies in ways to benefit citizens.

But the best news for the crypto industry came at the top of the ticket.

Margaret Brennan: Before this cycle, in June of 2021, Donald Trump was saying, “Bitcoin seems like a scam.” Do you understand what happened with that transformation?

Brad Garlinghouse: I didn’t have a front-row seat to that. I think it’s clear that Donald Trump embraced crypto and crypto embraced Donald Trump.

Three weeks before the election, Trump announced the launch of a new digital coin that he had a financial stake in.

Margaret Brennan: Is that a conflict of interest in your point of view?

Brad Garlinghouse: Whether or not it’s a conflict of interest, the voters have knowingly said, “We want this person to be our president. The voters have spoken more so than I have.

Trump’s Cabinet picks have had very positive things to say about crypto. Here’s what his choice for Treasury secretary, Scott Bessent, told Fox Business News…

Bessent on Fox Business News: “Crypto is about freedom and the crypto economy is here to stay”

Perhaps most significantly, this past week Trump selected a new head of the Securities and Exchange Commission. Paul Atkins – a former SEC commissioner who’s done some consulting for crypto companies, is expected to take a very different approach than Biden-era Chair Gary Gensler, who filed more than 120 lawsuits against crypto companies. Last year, Gensler told the House Financial Services Committee ….

Gensler: “I’ve never seen a field that’s so non-compliant with laws written by Congress”

Ripple CEO Brad Garlinghouse says the SEC’s approach was the main reason his company and two others created the biggest industry super PAC, called Fairshake.

Brad Garlinghouse: People are like, “Wh– why did– why did these companies come together and organize and say, ‘This matters'”? And– it– it’s a reaction to a war on crypto.

Margaret Brennan: So if the– if there had been a different SEC chair than Gary Gensler–

Brad Garlinghouse:I’m not sure Fairshake would exist.

Margaret Brennan: Really?

Brad Garlinghouse: I’m– absolutely.

60 Minutes

In response, an SEC spokesperson said: “any amount spent by the crypto industry on legal defense or influence peddling pales in comparison to the savings lost by crypto investors to frauds and failures.”

John Reed Stark: It was definitely a war on crypto.

John Reed Stark, former chief of internet enforcement at the SEC, says he owns no cryptocurrency and has never worked for the industry. Like Garlinghouse, he believes voters have given President-elect Trump a mandate to govern.

John Reed Stark: As far as these election results are concerned, the clear mandate is the SEC needs to lay off crypto And that’s exactly what’s gonna happen.

But that doesn’t mean this former SEC official thinks the agency’s actions were wrong.

John Reed Stark: crypto is a scourge. It’s not something that you want in your society. It has no utility. it’s just pure speculation. Remember, there’s no balance sheet to crypto. There’s no financial statements.

Margaret Brennan: You’re talkin’ about SEC filings. There’s no public disclosure mandate.

John Reed Stark: Exactly. Nothing. But also there’s no audit, inspection, examination, net capital requirements– no licensure of the individuals involved. And there’s no transparency into it. that creates real systemic risk, not just risk for investors But the other part that people don’t really talk about enough are the dire externalities that are enabled by crypto.

Margaret Brennan: What do you mean?

John Reed Stark: Every single crime you can conceive of is easier to do now because of crypto, especially ransomware, human sex trafficking—sanctions evasion, money laundering. North Korea is financing their nuclear weapons program using crypto.

Sam Bankman-Fried’s conviction for fraud at one of the largest crypto exchanges in the world is a case study of what can happen without proper oversight. Based in the Bahamas, the FTX exchange collapsed in 2022, imperiling $8 billion of customer assets, much of it beyond the reach of U.S. regulators.

Margaret Brennan: There were crimes there. There was fraud there.

Brad Garlinghouse: I view that as not t– dissimilar than if we say Bernie Madoff went to jail, that doesn’t make every hedge fund manager– a criminal.

Margaret Brennan: Of course–

Brad Garlinghouse: The– there’s a lotta good actors in crypto.

Ripple’s CEO says his company employs 900 people and has been working with regulated financial institutions to create a faster and cheaper way for people to send money overseas. XRP is the digital currency it uses to do that. But Ripple also sold the digital currency XRP to investors, and XRP now trades on exchanges, where people can buy or sell it in the hope of making a profit.

Margaret Brennan: So the SEC sued your company in December of 2020. That was the tail end of the Trump administration. Why?

Brad Garlinghouse: Well, their allegation was that Ripple and our sales of XRP represented the sale of an unregistered security.

Margaret Brennan: A security like a stock or another asset class?

Brad Garlinghouse: Correct.

Garlinghouse says Ripple has spent over $150 million fighting the SEC in court, arguing that the digital currency XRP shouldn’t be subject to the agency’s registration and disclosure requirements, as if it were a stock offering.

Brad Garlinghouse: I went to Harvard Business School. I think I’m reasonably intelligent about something like, “What is a security?” So never once had I considered the possibility– that, “Okay, maybe XRP’s a security.”

John Reed Stark: I’ve read every case. I’ve read every motion. And judges have said over, and over again that these are securities. And they haven’t said it like, “This is a close call.” They said, “This is an obvious call.”

60 Minutes

Brad Garlinghouse disputes that. He also argues that existing securities laws don’t fit well with the new technology, and Congress needs to draft new rules for these new digital assets.

Brad Garlinghouse: We haven’t been asking to be deregulated. We’ve been asking to be regulated. So we have been saying, “Hey, look, just give us clear rules of the road.”

Margaret Brennan: So w– what was your strategy with putting money to work in the election? Was it to then go write those rules of the road that you want written?

Brad Garlinghouse: No. Our– our goal has been to simply get rules written. I mean, the– the good news is there was–

Margaret Brennan: I mean, not just any rules.

Brad Garlinghouse: Well, th– there was– a bill passed this summer– in the House, bipartisan support called FIT21.

Margaret Brennan: Uh-huh.

Brad Garlinghouse: it was a Republican bill. Seventy-one Democrats supported it.

FIT21 tries to create a new regulatory framework for digital assets. While the SEC will still play a role, the legislation gives more responsibility for regulating cryptocurrencies to the CFTC, the Commodity Futures Trading Commission, which oversees futures markets for everything from gold to pork bellies…and already has some jurisdiction over bitcoin.

John Reed Stark: the SEC is about– maybe ten times the size of the CFTC. The SEC’s mandate is one of investor protection. They have legions of attorneys who go out and do these inspections, examinations, and audits. The CFTC is more about the integrity of the marketplace. I don’t blame the crypto industry for wanting to be under the CFTC. It’s a much easier regulatory regime.

Margaret Brennan: It had bipartisan support, and it passed the House.

John Reed Stark: Doesn’t surprise me at all that it has the support it has because–

Margaret Brennan: Why?

John Reed Stark: It doesn’t pay for a member of Congress or the Senate, whoever you’re talking about, doesn’t pay for them to be (laugh) anti-crypto. There’s no– there’s no one that’s gonna give them contributions because of that

Lawmakers from both parties told us crypto firms will not escape scrutiny, since there are consumer protections in the bill. And while it’s not clear whether republican leaders will reintroduce FIT21 in the new Congress, there is bipartisan agreement that something must be done to plug regulatory gaps and prevent confusion in a market that already exists.

Brad Garlinghouse: Where is the United States better served? Are we served by creating clear rules of the road and having this industry thrive here at home? Or should we push it offshore where people are less protected?

Margaret Brennan: But even some of the big financial names on Wall Street have been skeptical of crypto. Jamie Dimon called it pet rock

Brad Garlinghouse: There are big skeptics I think anytime a new technology, a new industry– emerges. The counter to what you’re describing is the most successful ETF ever in the United States–

Margaret Brennan: Exchange-traded fund.

Brad Garlinghouse: –was the Bitcoin ETF. The Bitcoin ETF went live I think in January of this year, and attracted more assets in– in a f– s– faster amount of time than any ETF ever before.

Exchange traded funds, or ETFs, are like mutual funds. Offered by well-known investment firms and big banks, they make it easy for people to invest in bitcoin or other cryptocurrencies without directly buying it themselves. Even Jamie Dimon’s bank offers clients investments in these assets he once described as pet rocks.

John Reed Stark: Am I surprised that these big banks have gotten into the crypto space? No, because there’s huge amounts of money to be made in fees.

Margaret Brennan: Do you think that everyday people who want to make money in the crypto space understand the risk that they assume?

Brad Garlinghouse: I think many people understand it’s a volatile market. And I think many people, you know, choose to participate. Many people choose to participate in the gambling market, also very risky. Should we, as– a government, tell people how they should and shouldn’t use the– their hard-earned money?

With the value of Ripple’s XRP currency up more than 300% since the election, Brad Garlinghouse recently announced the company was putting another $25 million into the industry super PAC Fairshake. With that donation, Fairshake already has $103 million to spend on pro-crypto candidates in the mid-term elections two years from now.

Produced by Andy Court. Associate producers, Annabelle Hanflig and Richard Escobedo. Broadcast associates, Grace Conley and Musa Ali. Edited by Warren Lustig

2024-12-09 00:00:22